FOR 2023

Understanding industry developments and their market effects will be crucial in 2023. The fast deployment of 5G networks, the shift from traditional telecommunications companies to Internet companies, the expansion of the IoT (Internet of Things) sector, and the significance of data are our themes of focus.

“How does this disruption affect me as a cell site owner?”

TO TECH COS

Increasing demand for digital services like cloud computing, smartphone applications, and the Internet of Things “IoT” has grown the telecom sector to include both traditional telecom firms (telcos) and tech corporations (tech cos) using these instruments.

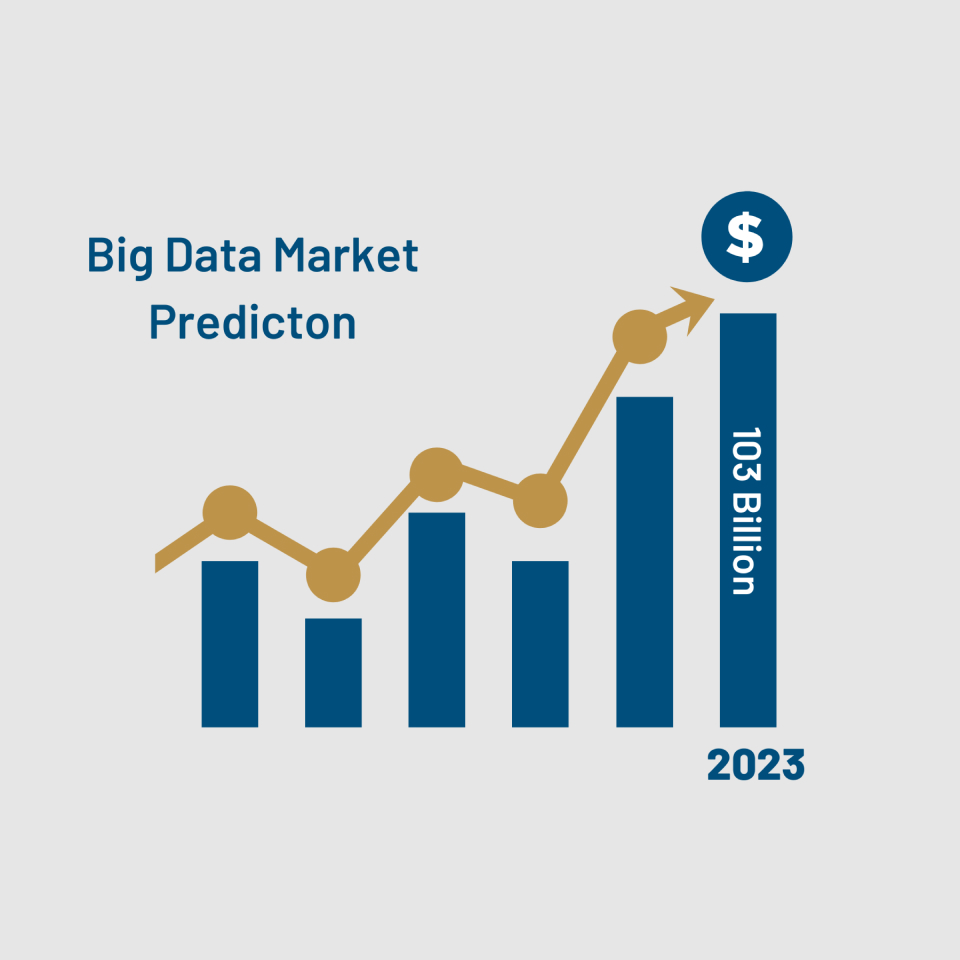

Big Data is expected to reach an all-time high of $103 billion by 2023, and Crypto markets are slowly starting to grow again (5). Due to this growth, demand for communication infrastructure is growing & some of the prospective tenants are acting on their ability to deploy capital and build their own. Simply said, Big Data is exploring ways to use, construct and manage cellular instruments.

Enter a profitable tenant… and a capable competitor.

FOR 2023

5G technology is rapidly maturing, promising faster speeds, lower latency, and more reliable connections. 5G is now poised to transform the telecommunications industry as we see new use cases ask for higher usage, in less physical space. Symphony Wireless Vice-Chairman, Jorge Pedraza, penned a piece outlining the impact of 5G on cell site owners; “First, it means that your tenant will probably have every interest in keeping their site on your property active and continuing to pay rent.”

However, Jorge points out that with 5G’s growth, “Legacy sites” are being shut down and newly constructed 5G sites allow for significant consolidation compared to existing assets. “The full impact of site consolidation from network acquisition is only now being felt. Carriers need to recoup their enormous investments and pay down their debt.”

Meaning: now more than ever, knowing your cell site’s present and future value is crucial to the continued revenue stream. (7)

DATA + ARTIFICIAL INTELLIGENCE

Data generation is accelerating day by day. Telecommunications companies keep massive volumes of client data to enhance customer experiences, network performance, and product development. Telecommunications companies are also poised to benefit from this influx of data as a conduit for transmission.

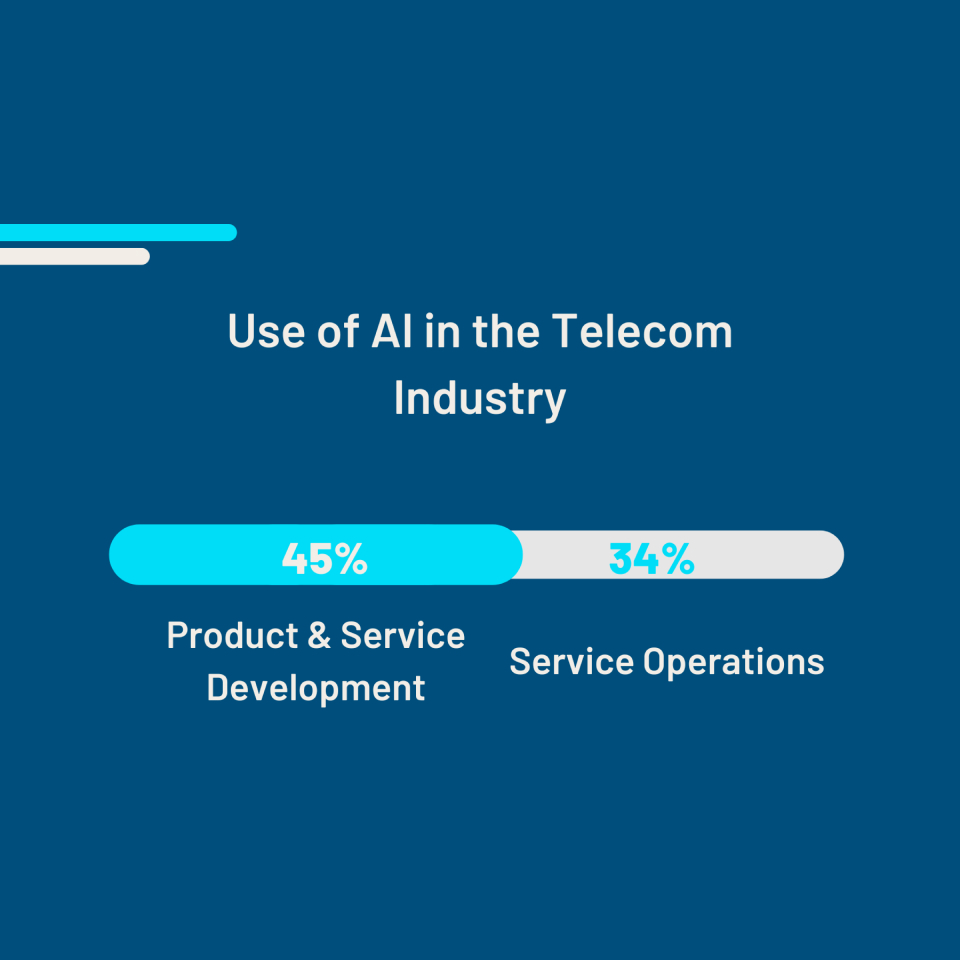

To keep up with massive influxes of data, the telecom industry is growing its asset footprint and working to ensure site efficiency. Surveys show that telecom companies use AI (Artificial Intelligence) heavily for product and service development (45%) and service operations (34%) (4). Ensuring growth, while focusing on efficiency in all facets. Further, AI can be instrumental in predicting tower equipment failures, and reducing network downtime.

Big data’s growth has birthed many new industries with projected growth in 2023, creating revenue opportunities for cell site owners and telecom providers (6). In fact, some companies like AT&T are moving 5G traffic to cloud services like Microsoft’s Azure service. This shift is providing more reliability to end-users with greater speed while also reducing the carbon footprint of the company.

Data, AI, increased connectivity, all attributes of an ever-changing landscape of telecommunications infrastructure. According to McKinsey & Company, telcos allocate 60% to 70% of their operating budget to field and service operations (2). Symphony has its finger on the pulse of these changes, and working with experts can ensure your site benefits as well.

FOR 2023

5G technology is rapidly maturing, promising faster speeds, lower latency, and more reliable connections. 5G is now poised to transform the telecommunications industry as we see new use cases ask for higher usage, in less physical space. Symphony Wireless Vice-Chairman, Jorge Pedraza, penned a piece outlining the impact of 5G on cell site owners; “First, it means that your tenant will probably have every interest in keeping their site on your property active and continuing to pay rent.”

However, Jorge points out that with 5G’s growth, “Legacy sites” are being shut down and newly constructed 5G sites allow for significant consolidation compared to existing assets. “The full impact of site consolidation from network acquisition is only now being felt. Carriers need to recoup their enormous investments and pay down their debt.”

Meaning: now more than ever, knowing your cell site’s present and future value is crucial to the continued revenue stream. (7)

IN THE ACQUISITION OF LEASES

Symphony Wireless understands the value of a telecommunications asset lease as a reliable source of income for cell tower and rooftop site owners. We provide personalized buyout offers that help our customers secure their future lease income through a lump sum payment.

With years of experience in the communications infrastructure industry, our team is committed to providing honest and fair capital opportunities. This experience and network aids in adding leases to a given instrument, if you sell an asset into Symphony’s portfolio you tap into its potential to add leases to that instrument. An option to share that revenue with you down the line is worked into our offering.

Symphony with a rolodex of telecom infrastructure professionals & a portfolio of sites is well situated in dense population areas, giving carriers a scaled array of options to choose from as they assign new leases.

"The Full Impact Of Site Consolidation From Network Acquisition Is Only Now Being Felt. Carriers Need To Recoup Their Enormous Investments And Pay Down Their Debt."

Jorge Pedraza, Vice-Chairman

FOR 2023

TELECOM OWNERS

In 2023, telecom owners maintain ever-increasing risk due to increased competition, disruption and rising operating costs. For cell site owners understanding these risks are paramount, as they affect the value of the owned asset.

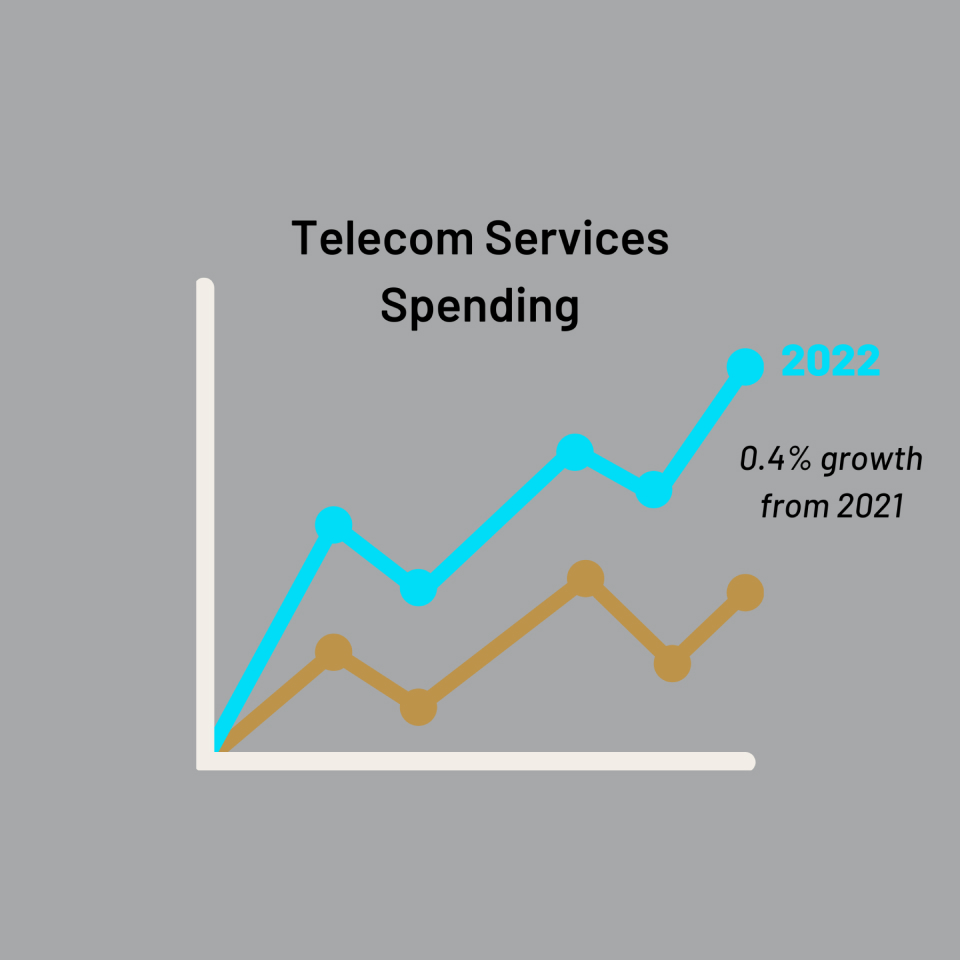

According to Statista “In 2022, telecommunication services spending is expected to amount to 1.46 trillion U.S. dollars, a growth of around 0.4 percent from the previous year, a more modest growth than in 2021, when the industry recouped some of the negative economic impact brought about by the coronavirus (COVID-19) pandemic” (8).

This is no small amount of money, investors may bring elements of caution to investing in telecommunications due to this disruption, making it harder for cell site owners to attract fair and valuable purchase agreements. Potentially making it harder for individual site owners to garner new leases or negotiate old ones without better standing, as carriers look to get volume-based deals as a way to improve efficiency.

Symphony Wireless’ expertise, the value wireless investors see in our scaled portfolio and our track record for operating efficiency are here to help you reduce this risk by providing transparency and clear value.

VALUE OF INFRASTRUCTURE ASSETS

Cell towers and rooftop locations are essential to providing high-quality telecommunications services. Operators risk losing considerable income if these assets are not utilized. Often sites are left empty and decommissioned due to recent changes in carrier needs, upgrades to nearby existing towers or commissioning new tower sites locally by developers or the carriers.

Symphony Wireless is a group of advisors first, creating options for cell site owners is what we do best.

INFRASTRUCTURE RESILIENCE AND REACH (3)

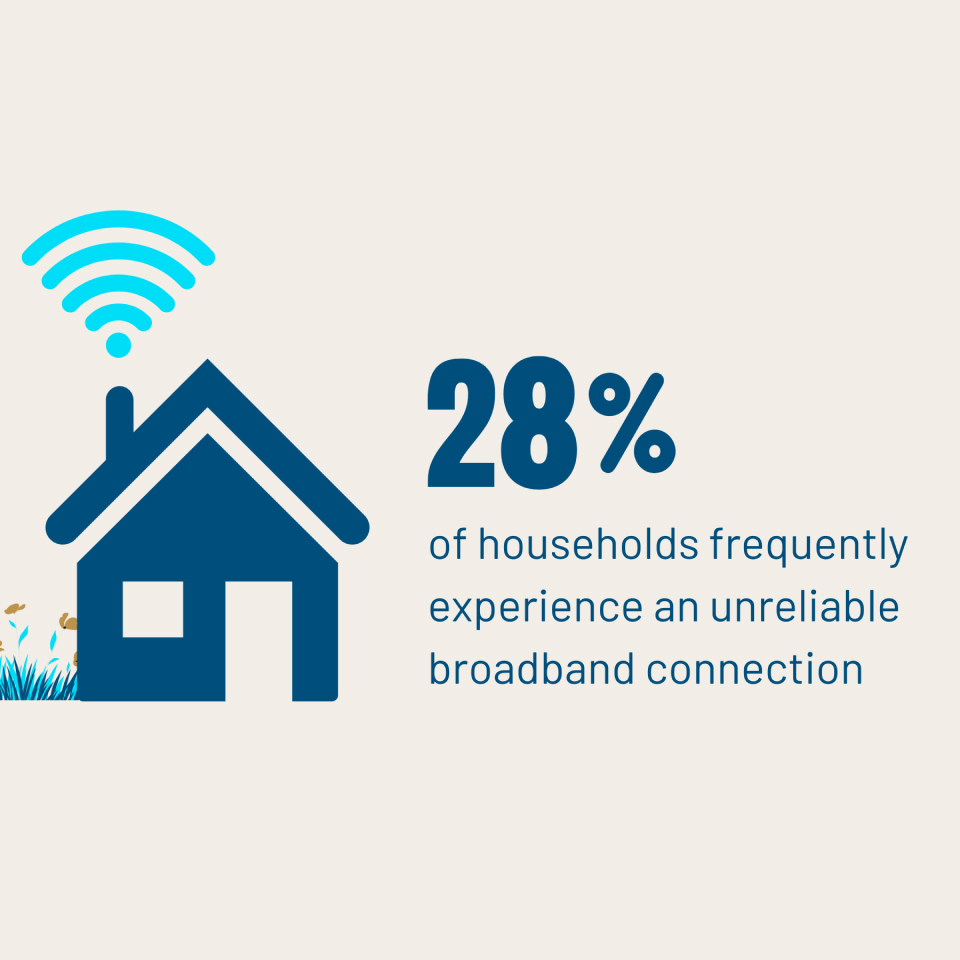

Network reliability remains a pain point for customers, with the EY Global Decoding the Digital Home Study (1) showing that 28% of households frequently experience an unreliable broadband connection.

The challenge for operators is compounded by relentlessly rising data usage. And the pressure on infrastructure is accompanied by continuing worries over the digital divide, with the pandemic having further polarized the digital haves and have-nots. Even in areas where networks are available, households struggle to afford packages, meaning more must be done to convert infrastructure coverage into take-up of services.

TO MITIGATE RISKS

As demand rises, this will bring growth, with growth comes capital expenditure which will ultimately lead to a prioritization of assets. Ultimately, this may lead to growth of more efficient assets or a volume-based approach to new lease growth by the carriers.

Either way, cell site owners of all sizes need to understand the risks and be ready to pull the trigger in response to an ever-changing landscape. Offloading risk, ensuring the asset is eco-friendly and up to date & growing the ability of the asset to hold more carrier leases are on a short list of options cell site owners have to keep up with the times.

HELPS MITIGATE RISKS

Symphony Wireless works to accommodate all potential businesses that have a need for cellular instruments. Working with cloud, IOT (Internet of Things) & Crypto vendors to complement our vast portfolio of cellular leases. Symphony works with its vast portfolio and partners to make sure that its sites are in top shape and harnessing sustainable sources of energy, thus expanding the lifespan and output of our owned assets. We understand the financial risk that cell tower owner share, this risk is mitigated by the growth of our portfolio. From one to many, we can reduce risk of any given location by building a nationally diversified pool. This is our unique advantage in the game of cellular infrastructure chess, while single site owners are playing checkers.

CONCLUSION

AI and 5G will alter the telecommunications business in 2023, creating challenges and opportunities. These technologies could continue to affect cell site leasing values. Cell site owners may find it easier to sell their lease if their telecom operator embraces change and adopts modern technologies.

The purchasing and selling of leases present chances for development and stability; nevertheless, hazards such as financial issues and the durability of the underlying infrastructure need to be handled.

By understanding the potential impact these factors could have on the value of their lease, cell site owners can make informed decisions and maximize the value of their assets. To ensure their continued success beyond the year 2023, businesses will need to learn to embrace change.